- 2021.07.20

justInCaseTechnologies, Inc. (“justInCaseTech”) today announces to rename the SaaS insurance solution, which was launched in January 2021, to “joinsure” and aims to join forces with more insurers to pursue the vision of “Create joy of helping and being helped for everyone”.

In addition, we are excited to launch a new feature “joinsure insurance claim filing chatbot” and offer it to SBI PRISM SSI Co., Ltd. starting in July 20, 2021. This service has won 1st place in the 1st Tokyo Financial Award.

In collaboration with Tokio Marine & Nichido Fire Insurance Co., Ltd., we will continue to introduce “joinsure” to more companies and increase the adoption.

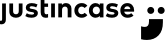

【About joinsure】

「joinsure」is a SaaS insurance solution that enables insurance companies to digitize customer touchpoints and optimize operation efficiency.

The new feature, “Insurance claim filing chatbot”, is added to the current joinsure’s insurance claim system.

Services

「joinsure Insurance Application System」

・Front-end design(Product page, application)

・Customer information registration and authentication

「joinsure Policy Management System」

・Policyholder portal(Policy review, change request, claim status check)

・Policy management(Reviews of application review, policy details, change and renewal, agency management)

・Billing management(Online payment, multi-payment support)

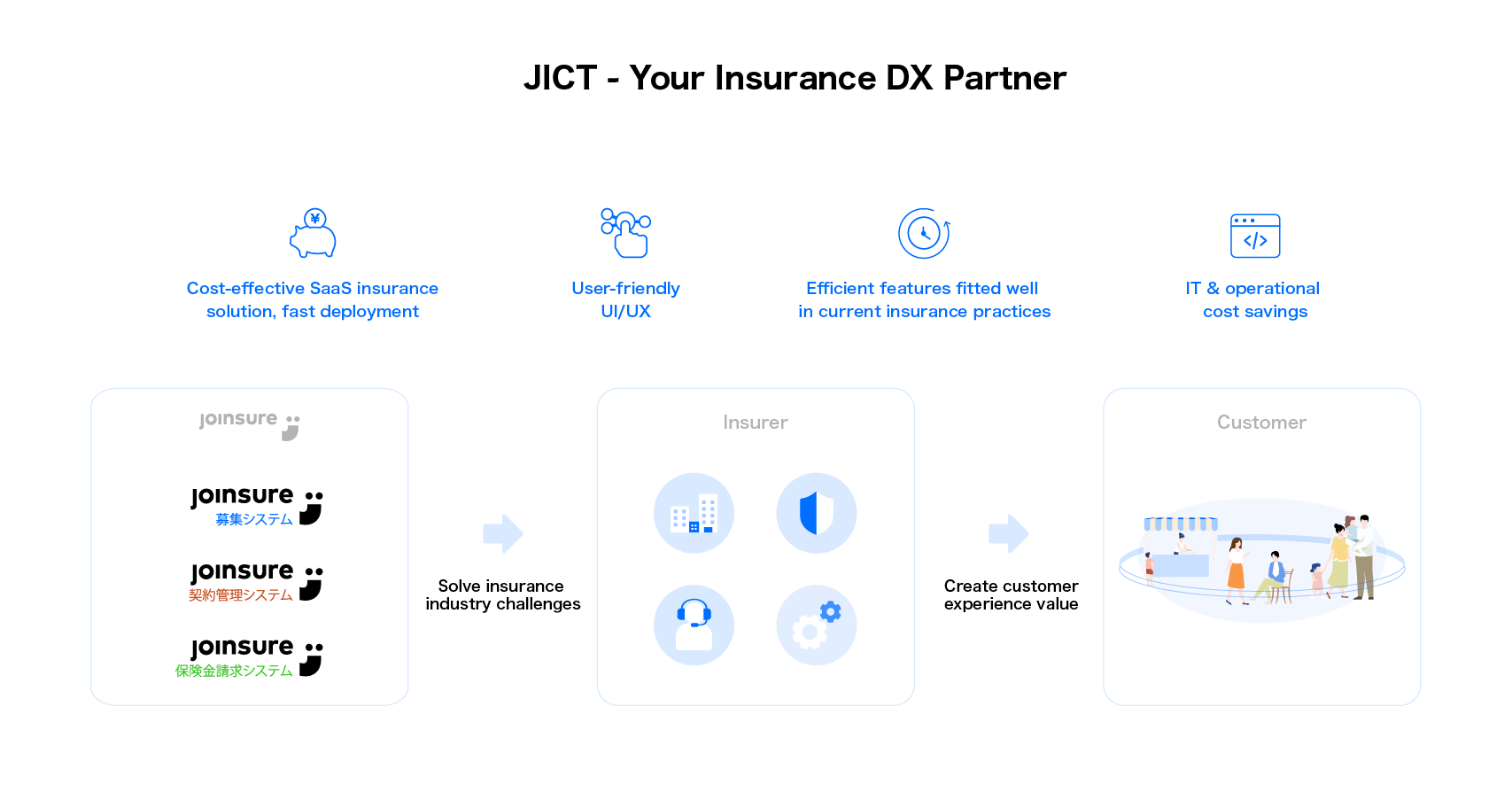

「joinsure Insurance Claim Management System」

・Insurance claim filing chatbot(New feature)

・Insurance claim management

Value of joinsure

– Speed to market

– Diversify channels to improve customer experience

– All paperless, fully digitized

– Move away from the legacy system to save costs of maintenance and operation

By creating these values at a low cost and with speed, we aim to deliver superior insurance customer experience, including the provision of a variety of insurance products as well as making the application process and claim payment have become much easier to understand.

With the vision of “Create joy of helping and being helped for everyone”, we will continue to partner with more insurance companies to advocate insurance DX together.

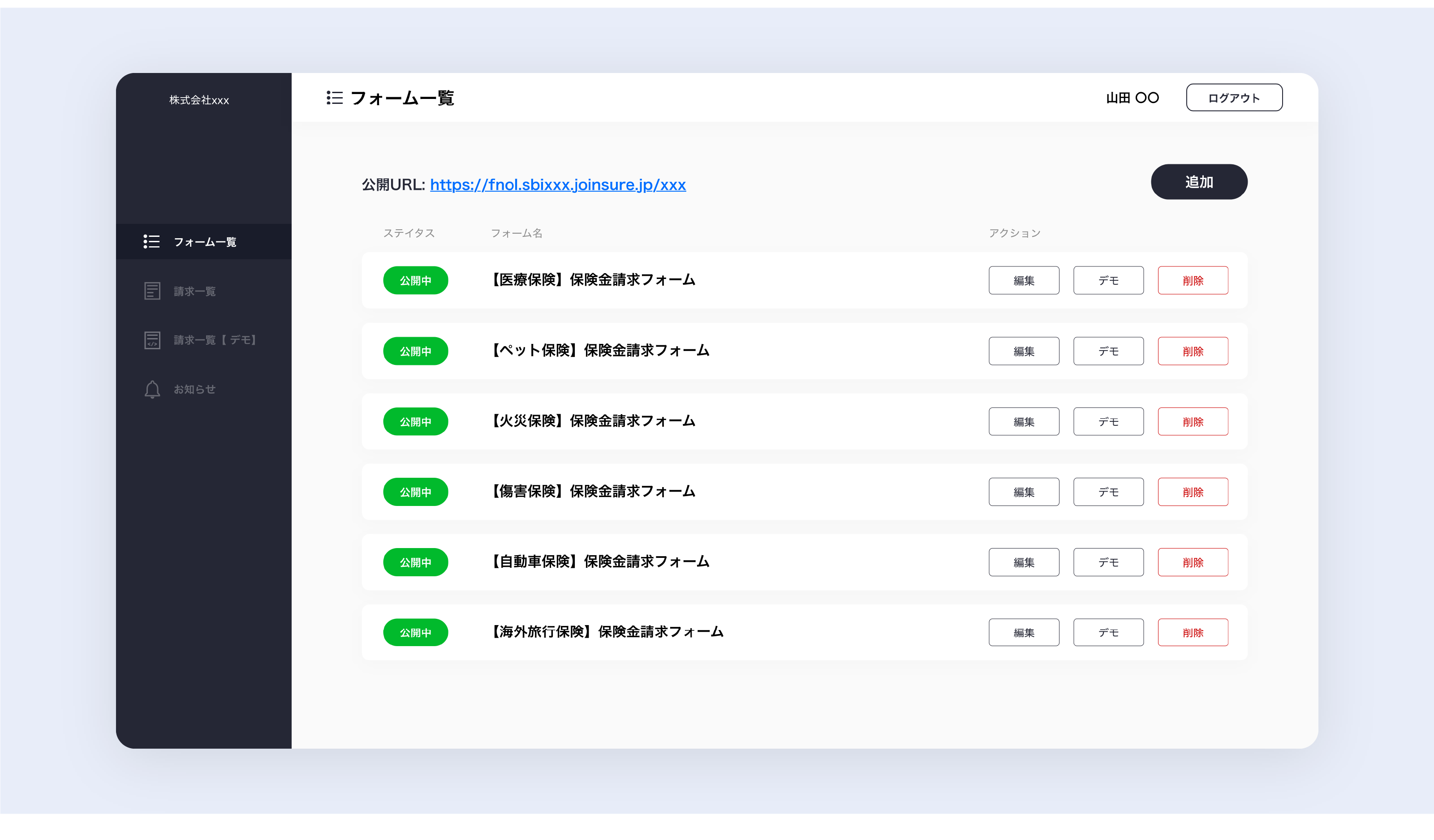

【New Feature「Insurance claim filing chatbot」】

Policyholder Value

When policyholders make claims, the documents and information they need to submit vary depending on the situation. With this new feature, policyholders can receive information on necessary documents and information in accordance with the specified situation at any time, and can complete the entire claim filing process via chatbot.

Insurer Value

Insurers can build and customize insurance claim flows for various products with no code, and can shorten the time to settle claim payments by eliminating the hassle of mailing. The new feature helps increase the online claim filing rate and reduce incomplete documentations.

While this feature can be adopted to all types of insurance products, we think the value can be especially maximized in the following types of insurance:

-Fire insurance in the event of a natural disaster

-Insurance with frequent claims, such as Pet insurance

-Accident insurance and health insurance with relatively simple claim process

【Comments from Mr. Endo, CEO of SBI PRISM SSI Co., Ltd. 】

The insurance claim submission by mail takes time and effort. The entire claims process also tends to become complicated for customers.

With the help of “joinsure insurance claim filing chatbot”, the process will be digitized and claim payments will be faster.

Moreover, we believe that by interacting closely with customers to provide them support throughout the claim process, we can handle the insurance claims smoothly, allowing customers to spend more time with their family pets.

This initiative will be one of our key services that meet customer needs. Such a SaaS insurance system also fits well into our system development themes from “creating” to “connecting.”

【About Tokyo Financial Award】

With the aim of improving the convenience of Tokyo residents and promoting financial revitalization, the Tokyo Financial Award recognizes financial companies that provide innovative financial products and services to address the needs and challenges of Tokyo residents, as well as financial companies that promote ESG investments.

In the 1st Tokyo Financial Award under the category of “Solving Residents’ Needs”, justInCase’s proposal of using “smooth insurance claims by chatbot” to solve the challenge of cumbersome insurance claim process won 1st place.

Press Release: https://news.justincase.jp/news/justincase_tokyofinancialaward_grandprize/?lang=en

【Learn more about joinsure】

Working in collaboration with Tokio Marine & Nichido Fire Insurance Co., Ltd., we are excited to have five companies going to adopt「joinsure Insurance Application System」this year.

For companies interested in speed to market, diversifying channels to improve customer experience, digitization or moving away from the legacy system to save costs of maintenance and operation

, please contact us using the form below.

【Comments from CEO Hata】

“The SaaS insurance solution is developed through the accumulated know-how and features that justInCaseTechnologies has provided for justInCase. The new feature added this time is devised to solve the inconvenience of customers and difficulties faced by insurance companies in the event of disasters such as the Great East Japan Earthquake and the Kumamoto Earthquake. Key issues include the cumbersome insurance claim filing process, which was also a concern raised in the Tokyo Financial Award, as well as the fact that many insurers feel uncertain about how far DX can benefit customers and how much they need to spend on IT to create best-in-class UX.「joinsure Insurance Claim Management System」is the solution to these issues.

Our vision is to “Create joy of helping and being helped for everyone” , reviving the custom of Japanese practicing “helping each other” from ancient times. In case of emergency, I have a sense of mission to ease the stress by smoothening the processes of insurance claim filing and claim and claim payment.

Insurtech plays a crucial role to realize a paperless industry and remote work that have become a new normal during the COVID-19. I am confident that the “joinsure Insurance Claim Management system” can make a significant contribution to reducing the enormous workload of call centre and operational costs.”

About justInCaseTechnologies

Established in 2019, justInCaseTechnologies provides reliable and seamless insurance API technology and digital platform solutions for justInCase, enabling justInCase to successfully launch five fully online insurance products in a year. justInCaseTechnologies also empowers insurers to digitize their service such as accepting premium payments by common points and credit card. Amid the growing demands for digital transformation in the insurance industry, including digitizing the customer touchpoints, automating and streamlining workflows, justInCase Technologies offers a SaaS insurance solution “joinsure” which is composed of insurance systems developed through our know-how and experience of pure online insurance development and system design.