- 2021.10.20

justInCase, Inc., with the vision of “Create joy of helping and being helped for everyone”, and justInCaseTechnologies, Inc. (hereafter both companies referred to as “the Company”) are pleased to announce the appointments of Ex-head of Financial Service Agency Mr. Toshihide Endo, Attorney-at-law Partner Mr. Masakazu Masujima, and Founding Member of Money Forward Mr. Toshio Taki to Advisory Board. With a stronger organization, the Company will continue to bring innovation to the insurance industry and strive further to accomplish our vision.

Photo Credit: Michael Holmes for justInCase

In January 2020, the Company participated in the Regulatory Sandbox System and introduced Japan’s first P2P insurance, “Warikan Insurance”, to the industry. The Company has taken on the challenge of redefining the value of insurance and reviving the concept of mutual support.

Coincidentally as society has been changing substantially, many people have experienced what mutual support is. The concept of mutual support has been widespread at a speed beyond imagination. We want to leverage technology to further expand the service in order to share the power of mutual support with everyone we have yet to meet but living with us. Amid the big shift toward the new normal, we strongly believe that we should not miss this moment to promote “the joy of helping and being helped for everyone”. It is time for revolution. Entering the second phase of the challenge, we formed the advisory board made up of three powerful members.

【Advisory Board Member Profiles】

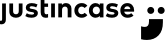

Mr. Toshihide Endo, Ex-head of Financial Service Agency

Endo has been active at the forefront of financial administration. He was appointed Head of the Financial Service Agency (FSA) in 2018. He left the position in 2020. He formerly served as Director of the FSA Inspection Bureau and Supervisory Bureau as well as Deputy Director of the International Monetary Fund (IMF) Asia-Pacific Bureau to engage in Basel standards. He has started to work for the Ministry of Finance since he graduated from the University of Tokyo Faculty of Law.

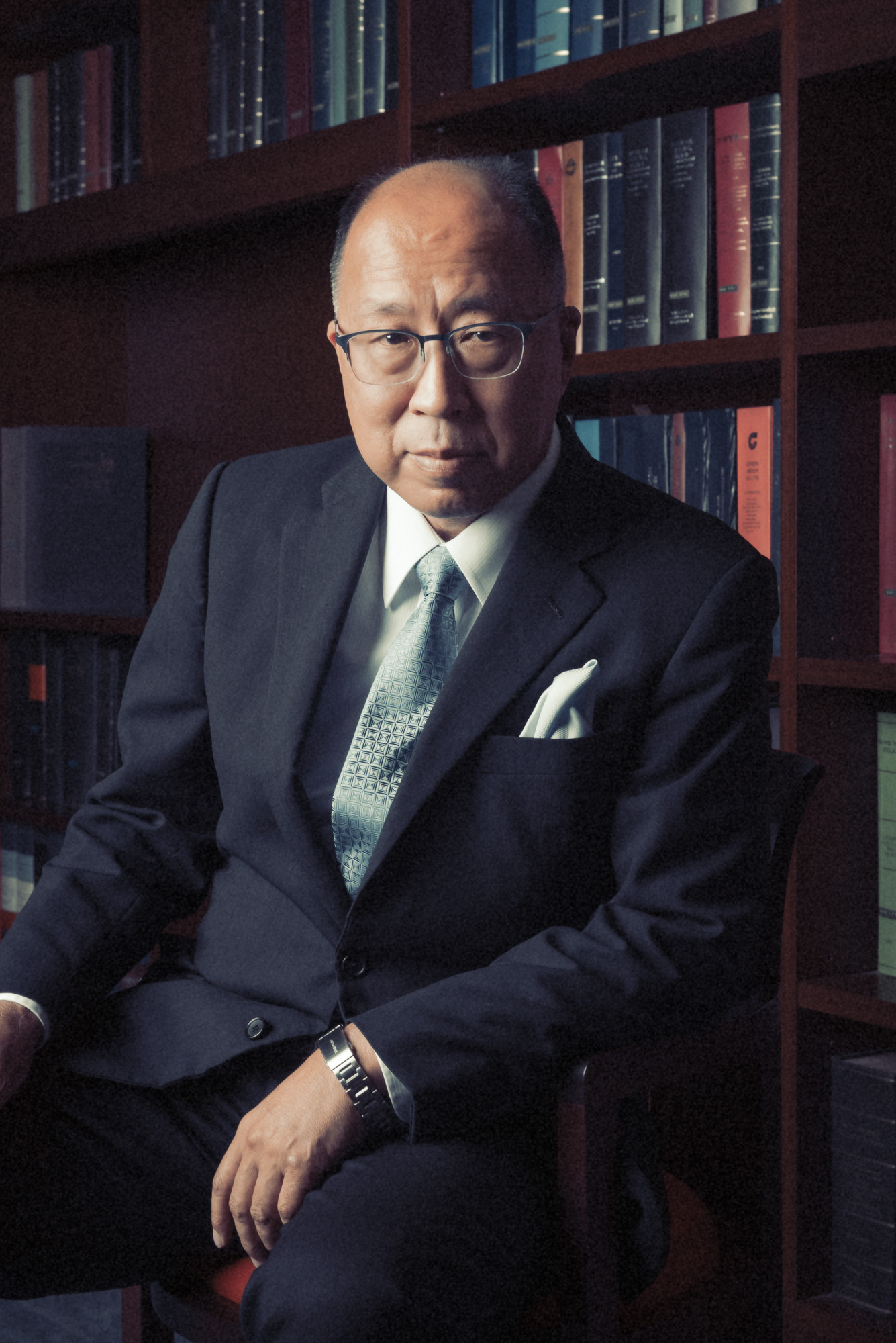

Mr. Masakazu Masujima, Attorney-at-law Partner at Japan’s leading law firm

Masujima used to be the Assistant Director of the Insurance Division of the Financial Services Agency’s Supervisory Bureau and the Bank’s First Division, bringing a wealth of knowledge in the finance field. He aims to establish a legal system and practical infrastructure that facilitate wide adoption of ecosystem-based business models through supplying risk money and supporting open innovation initiatives. He is a graduate of the University of Tokyo Faculty of Law and Columbia Law School.

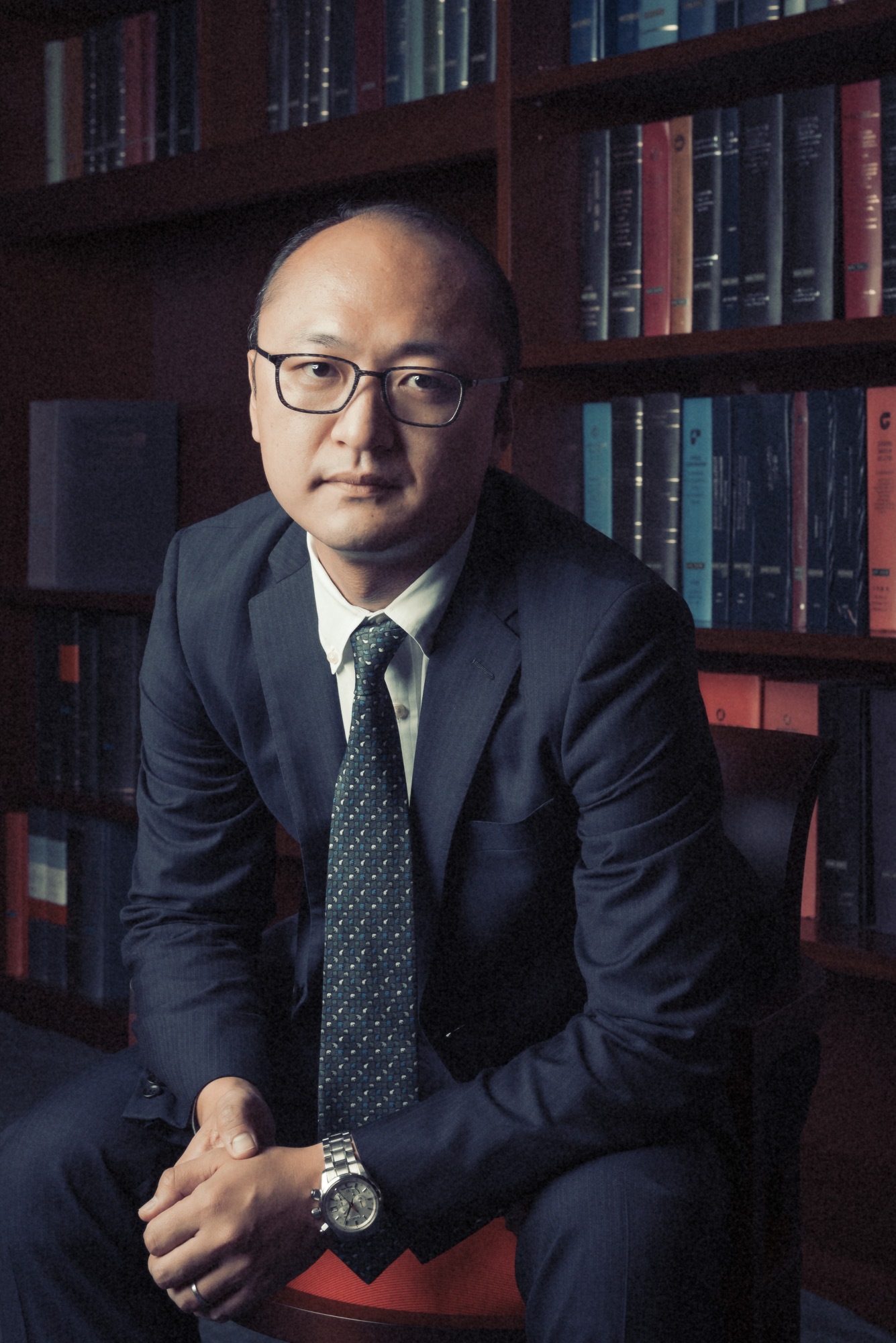

Mr. Toshio Taki, Founding Member of Money Forward, Japan’s first listed fintech startup

Taki is the founding member of Money Forward, a fintech startup established in 2012. Prior to founding Money Forward, Taki served corporate planning in Nomura Holdings and engaged in research work on topics including household behavior, pension system and business models of financial institutions. He is the director of Fintech Research Institute. He received his M.B.A. at Stanford University and B.A. in Economics at Keio University.

【Comments from Board Members】

Upon the appointments to the advisory board, we have received comments from the board members regarding the white paper ー Roadmap for the Future of Insurtech that JIC and JICT aim to achieve.

(Download the white paper here: https://justincase.jp/whitepaper/whitepaper20210929_en.pdf)

Comments from Mr. Toshihide Endo, Ex-head of Financial Service Agency

“Currently many insurers are somehow aware of the progression of InsurTech in the industry, but they are not responding to it. I think this white paper is a very useful guidance and brings a lot of excitement to our insurance industry. I believe that I can contribute to the development of our insurance industry through participating in the advisory board discussions and supporting justInCase along the way.”

Comments from Mr. Masakazu Masujima, Attorney-at-law Partner

“In Japan, although insurance is modularized at document level, it is developed as a product to be sold at IT system level. Hence, it is difficult to meet the demands of product flexibility and customer-driven personalized design. For this reason, I believe if we can design an architecture that is compatible with the complex system of insurers’ sales of “insurance products” that combines the document-based policy contract system and IT system, meeting various needs in a scalable manner, it will be a competitive advantage. Traditional insurers have been struggling with legacy issues of the document modulars and IT systems. However, in practice it is uneasy for them to pursue what they want as they are bound by regulations such as two prices for one item. Having said that, regulations and systems are the same in the sense that they are artificial objects. As long as they are not restricted by the laws of physics, they can be changed by someone who is strong-willed. Whether you are startups, traditional insurers, government bodies or private companies, everyone with aspirations is the main role of steering the future of insurance in Japan. Let’s do our best to connect the world-class Japanese insurance industry to the next generation and have a positive impact on the world!”

Comments from Mr. Toshio Taki, Founding Member of Money Forward

“In the age of VUCA, as we are facing changing risk and uncertainty, I believe that it is important to provide new insurance products and develop technology capabilities. However, it is also well understood that changing the insurance industry is uneasy as this is an industry that requires the business to have scale and abide by rules and regulations.

The idea of innovation and infrastructure modernization introduced in this white paper is important for the insurance industry to gradually undergo the transformation on its own. As an advisor, I would like to contribute to the development of products targeting the future customer base like Gen-Z, making them happen in the near future.”

【Comments from CEO Hata】

“It is very encouraging to have these three experts to be our advisors. I look forward to having meaningful discussions with the board about the future of the administration matters and regulations in the insurance industry, the future of InsurTech, and the way InsurTech should be together with the evolution of Fintech as a whole. As stated in the white paper, like many of the other industries, insurance industry has begun the digital transformation journey. As a pioneer, we will continue to take on various challenges in both the insurance business and the insurance SaaS business. While I know that this journey with the support from our advisory board and employees only will be hard, I truly believe that more and more people feel the need to make a change like us. Transformation is something that we cannot achieve on our own and therefore we want to work with all the people around us to make it happen.”

About justInCase

Established: December 2016

CEO: Kazy Hata

Location: 702 Kayabacho 1-chome Heiwa Building, 1-8-1, Nihonbashi Kayabacho, Chuo-ku, Tokyo

Business: Small amount and short term insurance

Business started: July 2018

With the vision to “Create joy of helping and being helped for everyone”, justInCase has launched an insurtech business to use technology to transform the insurance industry. We are here to create values that improve everyone’s lives by offering insurance products and services that are yet to exist.

https://justincase.jp/

About justInCaseTechnologies

Established in 2019, justInCaseTechnologies provides reliable and seamless insurance API technology and digital platform solutions for justInCase, enabling justInCase to successfully launch five fully online insurance products in a year. justInCaseTechnologies also empowers insurers to digitize their services such as accepting premium payments by common points and credit card. Amid the growing demands for digital transformation in the insurance industry, including digitizing the customer touchpoints, automating and streamlining workflows, justInCase Technologies offers a SaaS insurance solution “joinsure” which is composed of insurance systems developed through our know-how and experience of pure online insurance development and system design.

https://justincase.jp/joinsure